In today’s highly volatile insurance industry, one truth is becoming harder to ignore: data is everywhere, but it’s not always working for us.

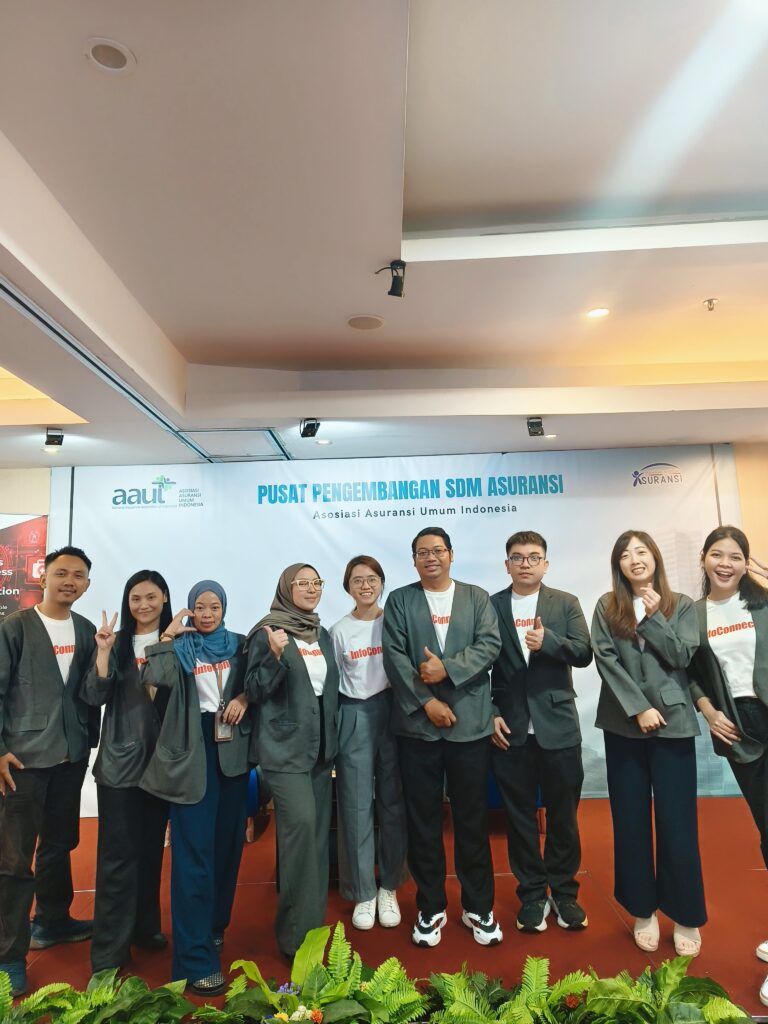

That was the starting point of our recent session with Asosiasi Asuransi Umum Indonesia (AAUI) in Jakarta, where our Director and Malaysian colleagues joined forces with our energetic team from PT InfoConnect Solusi Indonesia. Themed “Towards a Data-Driven Insurance Era: Is Your Foundation Ready?” on the 20th of August 2025, the discussion centred not on tools alone, but on the bigger question of how insurers can transform scattered information into a true competitive advantage.

Across the industry, the struggles look familiar:

- Customer data duplicated across multiple systems.

- Claims that take too long to validate.

- Reports that don’t align, slowing decision-making.

- New compliance demands from regulations like Indonesia’s PDP Law and OJK’s governance requirements.

These aren’t just technical headaches — they affect how fast insurers respond to customers, how quickly they can close their books, and how well they can remain resilient in a fast-changing market.

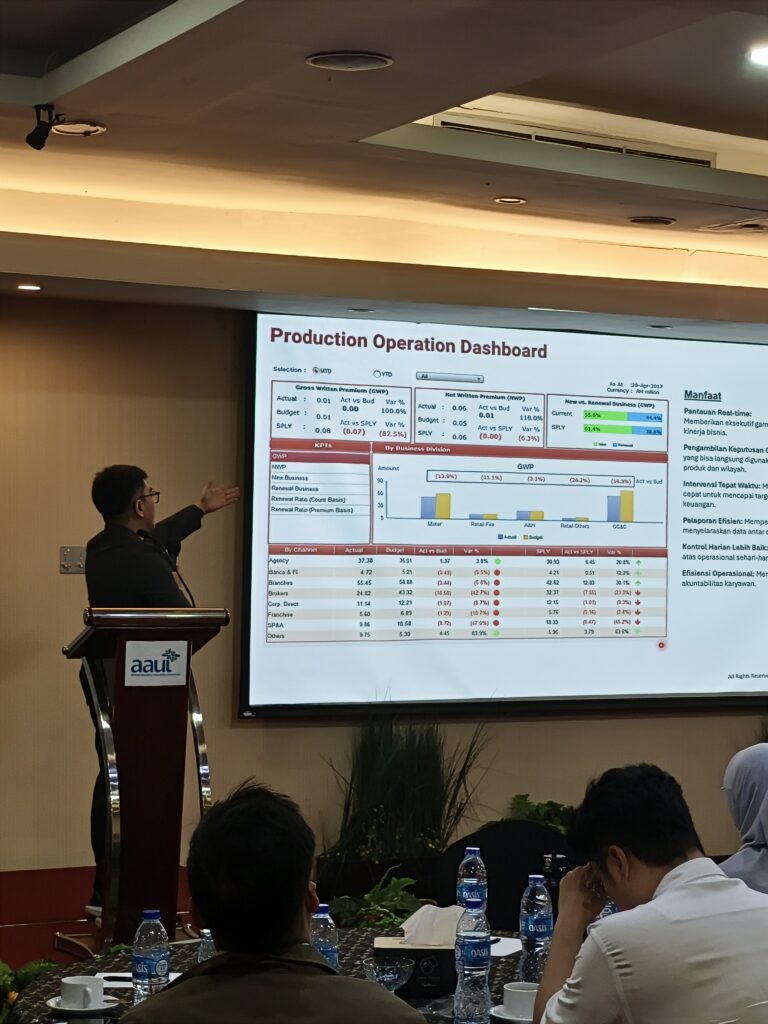

To illustrate what’s possible, we shared a relevant case study from Malaysia. The insurer in this example faced a situation many can relate to: fragmented reporting processes, data scattered across departments, and over-reliance on manual Excel reconciliation. Their teams were spending valuable hours just piecing information together, leaving little room to focus on innovation or customer service.

The solution implemented was a centralized data platform designed to unify their core insurance data into a single source of truth. By automating data ingestion, validation, and cleansing, the insurer gained a consolidated view of operations across underwriting, claims, finance, and customer management.

The benefits were immediate and measurable:

- Faster reporting: What once took weeks to reconcile now happens in near real-time. This shortened reporting cycles dramatically, especially during monthly closing periods.

- Consistent insights: With standardized metrics across the organization, decision-makers no longer struggled with conflicting versions of reports.

- Empowered teams: Self-service dashboards enabled business users to create their own reports and run analyses without relying heavily on IT, freeing up the tech team to focus on innovation.

- Improved customer service: With data unified, claims validation became quicker and more accurate, allowing faster response times to policyholders.

This case study wasn’t just a technical win — it showed how strong data foundations can translate into better business performance and customer trust.

Participants also got a glimpse of what lies ahead through our live demo session, showcasing how AI and analytics are reshaping insurance operations today. Fraud detection dashboards, claim forecasting, customer churn prediction, and risk profiling are no longer abstract concepts. They’re practical tools that help insurers move from reactive firefighting to proactive planning.

But what truly brought the session to life was the engaging dialogue that followed. Guided by AAUI’s own Miss Nelly Novitawathy, the Q&A surfaced real concerns insurers are grappling with: fragmented data, regulatory pressures, and preparing for a more AI-driven marketplace. These discussions underscored how crucial it is for insurers to embrace technology not just for efficiency, but for resilience and competitiveness in the years ahead.

Three key takeaways stood out from the day:

- Data foundations matter — clean, centralized, and well-governed data is the launchpad for innovation.

- Compliance is non-negotiable — regulations demand it, and trust depends on it.

- AI is here now — automating claims, predicting churn, and enabling more personalized services.

In the end, the session was not just about sharing insights but sparking a conversation that will shape the next chapter of insurance in Indonesia. For us, it was a privilege to contribute to this dialogue, and we remain committed to supporting insurers on their journey toward becoming truly data-driven enterprises.